Beyond ACP: Other End-of-Life Planning Matters

Life is unpredictable and it is important for us to be prepared for any unexpected situations. Starting end-of-life (EOL) planning with our parents early can help to bring peace of mind and allow us to focus on caring for them in their final days. Apart from Advance Care Planning (ACP), there are other aspects of EOL planning that can help to better manage the passing of our loved ones.

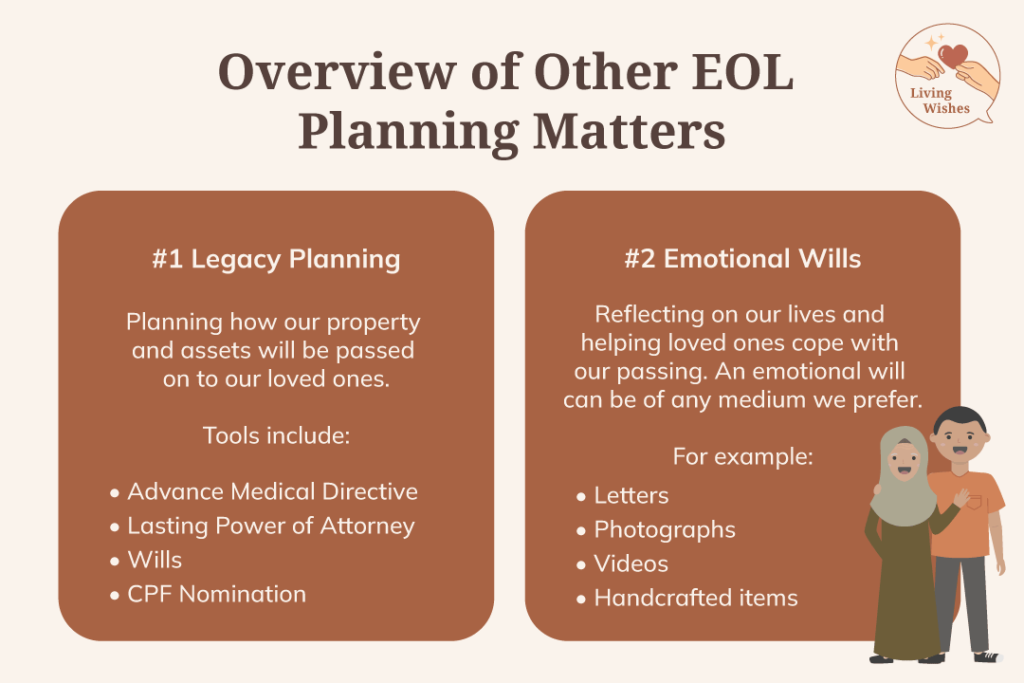

#1: Legacy Planning

Legacy planning involves planning how our property and assets will be passed on to our loved ones. There are several legal tools to help us with legacy planning such as the Advanced Medical Directive, Lasting Power of Attorney and Central Provident Fund (CPF) Nomination. Creating a legacy plan helps to ensure that our remaining family members can live comfortably and have greater bandwidth to grieve properly, rather than having to focus on administrative matters.

Some tools to help with legacy planning in Singapore include:

Advance Medical Directive (AMD)

The AMD is a legal document to inform medical practitioners that we do not want to receive any extraordinary life-sustaining treatments in the event we become incapacitated, unconscious or terminally ill.

While we can communicate our preferences and thoughts on life-sustaining treatments during an ACP discussion, an AMD is legally-binding and will ensure that medical practitioners have a duty to act in accordance with the signed document.

Lasting Power of Attorney (LPA)

An LPA is a legal document that allows you to appoint a person who is at least 21 years old to manage your personal and property affairs in the event you lose your mental capacity.

Wills

A will is a written document that allows you to state who your estate will be distributed to. It sets out who the beneficiaries of your assets will be and what each of them will get. If you have several dependents, having a will is especially useful in preventing any familial disputes over your assets and ensures that your remaining family members will be able to get by financially even after your passing.

CPF Nomination

Savings in your CPF account cannot be distributed in a financial will. Without a CPF nomination, it will be distributed according to Section 7 of the Intestate Succession Act or according to Muslim law for Muslims.

Anyone aged 16 years old and above with a sound mind can make a CPF nomination. As such, it is important to make a CPF nomination when we are healthy to ensure our assets are distributed according to our wishes.

#2: Emotional Wills

An emotional will involves sharing our thoughts, well-wishes and lessons learnt in life with our loved ones. It is not a legal document and we can choose our emotional will to be of any medium we prefer. This can include letters to friends and family, photographs, handcrafted items, audio or video recordings.

Emotional wills are meant to help us reflect on our lives and help our loved ones cope with our passing. When starting on your emotional will, you may reflect on the relationships in your life, memories you’ve had and include any physical mementos you would like to share.

As future decision-makers for our parents, it is important for us to find out their EOL wishes and help them to engage in EOL planning while they are still healthy and well. Visit our end-of-life planning resources page for useful links to help you get started!